THE NEW ERA OF DIGITAL ASSET INVESTING

Where institutional-grade technology meets intelligent automation. We empower you to capture market opportunities, build your own custom crypto index funds, and automatically grow your long-term Crypto Strategic Reserve.

NAVIGATING THE DIGITAL ASSET MAZE

The digital asset market operates 24/7, creating significant challenges. The pressure to act quickly often leads to decisions based on incomplete data, while the fear of missing out can override sound strategic planning.

You and your company are constantly battling:

Information Overload

An impossible deluge of news and data makes it difficult to identify what truly moves the market.

Hidden Risks

Volatility is just the beginning. True risk lies in unvetted assets, flawed strategies, and emotional decision-making.

Building a Winning Portfolio

Beyond buying individual assets, how do you construct a diversified, intelligent portfolio with a clear objective, like outperforming Bitcoin?

Short-Term vs. Long-Term Conflict

It's difficult to focus on building a long-term foundation when you are consumed by short-term market movements.

It's time to replace uncertainty with a systematic, goal-oriented approach.

PROVEN OUTPERFORMANCE

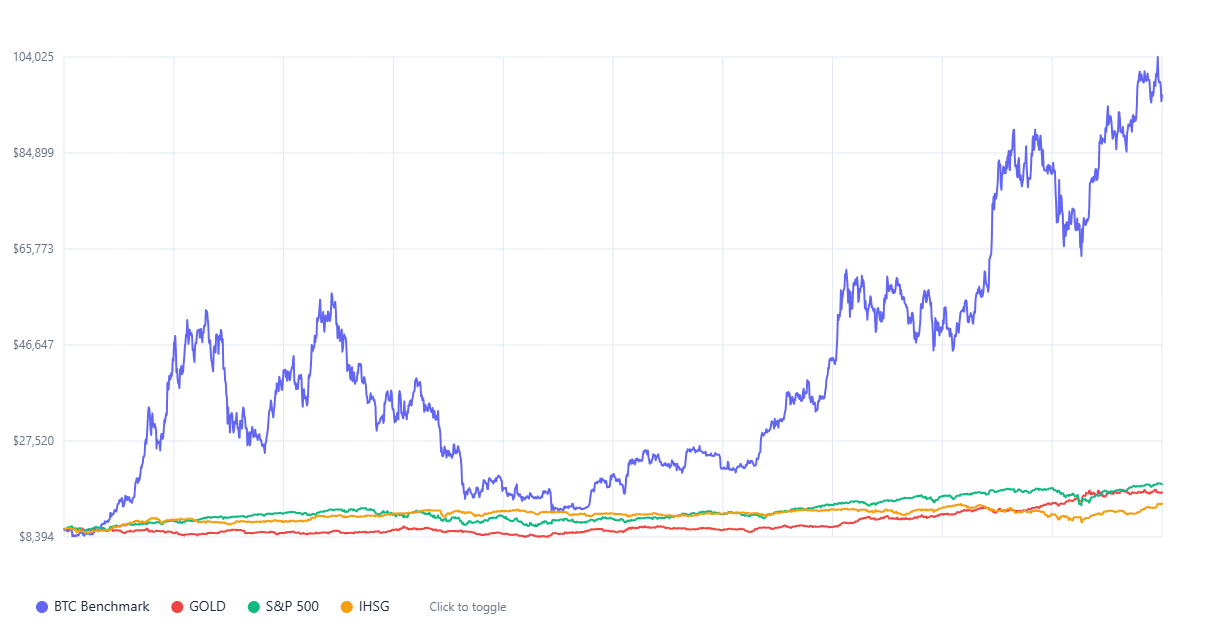

See how our strategic approach compares to traditional assets. Our data-driven methodology consistently outperforms Bitcoin, Gold, S&P 500, and IHSG.

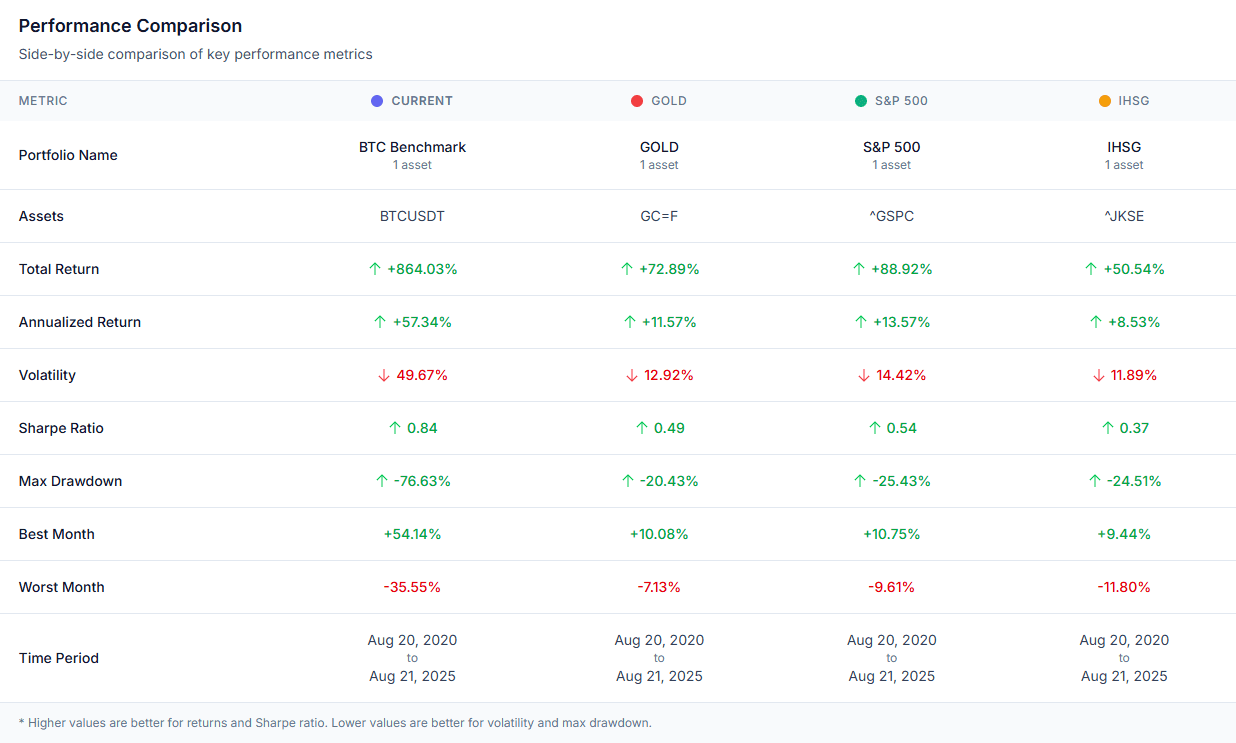

Performance Comparison

BTC vs GOLD vs S&P 500 vs IHSG - Historical Returns Analysis

Comparative analysis showing superior performance across multiple asset classes

Detailed Performance Metrics

In-depth analysis with risk-adjusted returns and volatility metrics

Comprehensive breakdown of performance indicators and risk metrics

Higher Returns

Consistent outperformance against major asset classes over multiple time periods

Risk Management

Superior risk-adjusted returns with controlled volatility and drawdown metrics

Data-Driven

Systematic approach based on quantitative analysis and proven methodologies

DESIGNED FOR PROFESSIONALS. BUILT FOR PERFORMANCE

For Investment Managers & Hedge Funds

Launch innovative products for your clients. Use our platform to design, manage, and scale custom-weighted portfolios, crypto index funds, and ETF frameworks—all designed to outperform key benchmarks like Bitcoin.

For Family Offices & High-Net-Worth Individuals

Move beyond a simple crypto reserve. Construct a sophisticated, diversified digital asset portfolio or a private index fund designed to beat the market and drive generational wealth.

For Corporate Treasuries & Businesses

Prudently add Bitcoin to your balance sheet. Use our platform to automate your treasury reserve policy, systematically converting corporate assets into a strategic crypto holding to preserve long-term value.

Professional Portfolio Analytics

Inspired by institutional-grade tools, our platform provides comprehensive backtesting and portfolio optimization capabilities.

Portfolio Backtesting

Test historical performance of custom asset allocations with detailed risk metrics, drawdown analysis, and rolling returns across multiple time periods.

Asset Allocation Tools

Design custom portfolios with percentage-based allocations, equal weighting options, and normalization tools for optimal portfolio construction.

Multi-Source Data

Access comprehensive cryptocurrency data from multiple providers including Binance, Yahoo Finance, and Coinbase with ticker symbol search functionality.

ASTRIX

Advanced AI-powered trading algorithms that analyze market patterns, execute strategies, and optimize portfolio performance automatically with intelligent risk management.

Loading featured portfolios...

Comprehensive Analysis Tools

Everything you need for professional portfolio management and analysis

Trading Dashboard

Real-time cryptocurrency charts with technical indicators, multiple timeframes, and professional-grade market data visualization tools.

Portfolio Constructor

Design and backtest custom cryptocurrency portfolios with sophisticated asset allocation tools and comprehensive performance analytics.

Ready to Get Started?

Join ARIES and access professional-grade portfolio analytics tools today.